[ad_1]

Bloomberg Intelligence senior commodity analyst, Mike McGlone, believes a “heat spell” is coming by way of bitcoin markets because the market strategist detailed on Monday that “bitcoin seems poised to renew its inclination to outperform.” McGlone’s feedback comply with his earlier prediction that famous bitcoin and ethereum seem to have “accomplished the majority of their drawdown.”

Mike McGlone Believes a Crypto ‘Heat Spell’ Is within the Playing cards, Suggests Bitcoin Will Resume Its Climb in Worth When the ‘Fed Pivots to Easing’

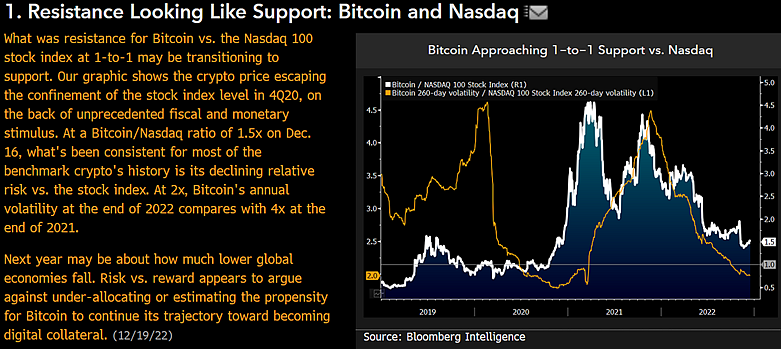

Mike McGlone is satisfied bitcoin has some therapeutic forward as he lately tweeted a couple of “heat spell” on Monday. McGlone’s remark particulars that “what was resistance for bitcoin vs. Nasdaq 100 inventory index at 1:1 could also be transitioning to assist.” McGlone additionally shared a chart that he says signifies the “crypto worth escaping confinement of the inventory index stage in 4Q20, on the again of unprecedented fiscal and financial stimulus.”

Proper now, McGlone says what’s been constant for a lot of the benchmark crypto’s historical past is “its declining relative threat vs. the inventory index.” “At 2x,” the market strategist continues, “Bitcoin’s annual volatility on the finish of 2022 compares with 4x on the finish of 2021.” Bloomberg’s senior commodity analyst added:

Subsequent yr could also be about how a lot decrease international economies fall. Threat vs. reward seems to argue in opposition to under-allocating or estimating the propensity for bitcoin to proceed its trajectory towards turning into digital collateral.

Bitcoin Crosses, the Crypto Seems to Regain Higher Hand Over Tesla — The close to certainty of declining #Bitcoin provide vs. the rising quantity of #Tesla shares excellent favors outperformance by the crypto, if the foundations of economics apply. pic.twitter.com/JNQVpOB6za

— Mike McGlone (@mikemcglone11) December 19, 2022

Bitcoin is down greater than 75% decrease than the crypto asset’s all-time excessive (ATH) reached on Nov. 10, 2021, at $69,044 per unit. During the last 14 days, BTC has slid 2.3% decrease in opposition to the U.S. greenback and for the reason that begin of Nov. 2022, following the FTX collapse, BTC has dropped 16.5% in opposition to the dollar. Bitcoin’s market capitalization is round $322 billion, which represents 38.2% of the $843 billion crypto economic system.

McGlone suggests bitcoin’s heat spell, nonetheless, received’t come to fruition till the U.S. Federal Reserve pivots towards financial easing. “A heat spell forward,” McGlone added. “Bitcoin Crosses vs. Propensity to Outperform – The world’s benchmark digital asset has taken a beating in 2022 with most others, however bitcoin seems poised to renew its inclination to outperform. When the Fed pivots to easing,” McGlone’s tweet concludes.

What do you concentrate on Bloomberg’s senior commodity analyst Mike McGlone’s opinion in regards to the heat spell forward? Tell us what you concentrate on this topic within the feedback part beneath.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct provide or solicitation of a proposal to purchase or promote, or a advice or endorsement of any merchandise, providers, or firms. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the writer is accountable, straight or not directly, for any harm or loss precipitated or alleged to be brought on by or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]