[ad_1]

One of many causes individuals are enthusiastic about DeFi is that it permits customers to method investments the identical means banks would. And with the development of decentralized finance, a flurry of thrilling trade platforms proceed to pop up.

Nevertheless, with customers continuously on the lookout for higher providers and simpler interfaces, only some make it to mainstream adoption.

If you wish to commerce cryptocurrency on decentralized exchanges (DEX), you could have a number of choices on nearly each blockchain, and it may be difficult to know the place to start. This text highlights every little thing you might want to find out about SushiSwap, one of the distinguished DeFi platforms. Let’s dive in!

Govt Abstract

- SushiSwap is a decentralized multi-chain trade (DEX).

- SUSHI is the token tied to the SushiSwap trade.

- Whereas Sushi initially began as a fork of Uniswap, the 2 exchanges have moved in the direction of totally different product targets.

A Transient Introduction to SushiSwap

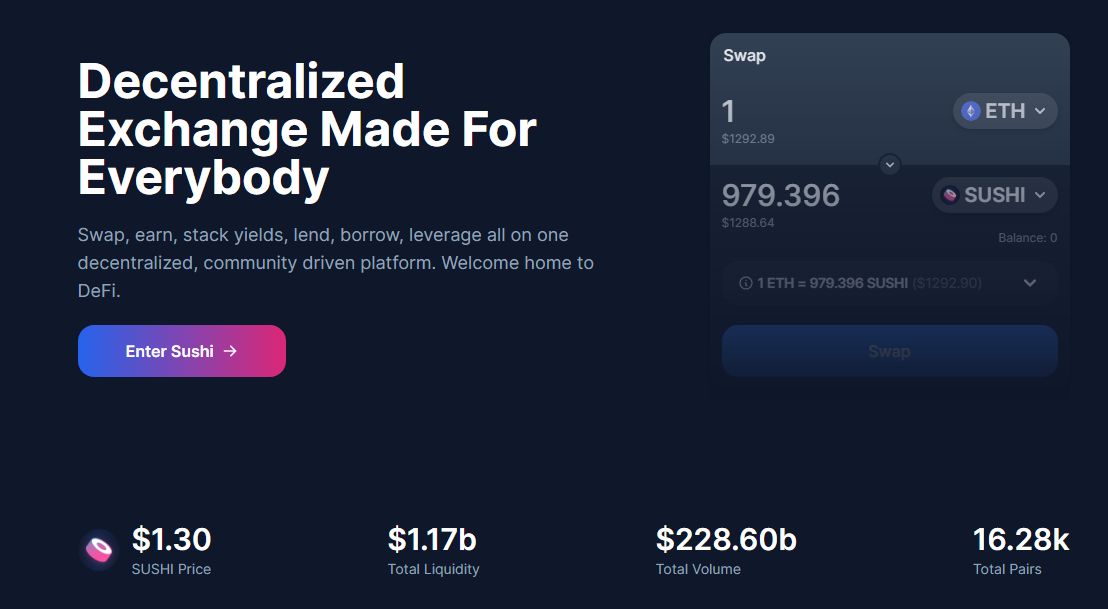

SushiSwap (SUSHI) is a multi-chain decentralized trade (DEX). The trade began out as a fork of Uniswap that makes use of good contracts to offer liquidity swimming pools that permit customers to commerce crypto property instantly with no middleman.

Customers can even develop into liquidity pool suppliers, supplying an equal-value pair of two cryptocurrencies in trade for rewards at any time when that pool is used.

Sushi is a community-driven group based to deal with the “liquidity drawback” of decentralized exchanges. This concern could possibly be outlined as the lack of varied types of liquidity to attach with markets in a decentralized method and vice versa.

Whereas different options make incremental progress towards fixing the liquidity drawback, Sushi’s progress is meant to generate a broader vary of community results. Quite than specializing in a single answer, Sushi intertwines many decentralized markets and devices.

Thus far, the core merchandise are as follows: a decentralized trade, a decentralized lending market, yield devices, an public sale platform, an AMM framework, and staking derivatives.

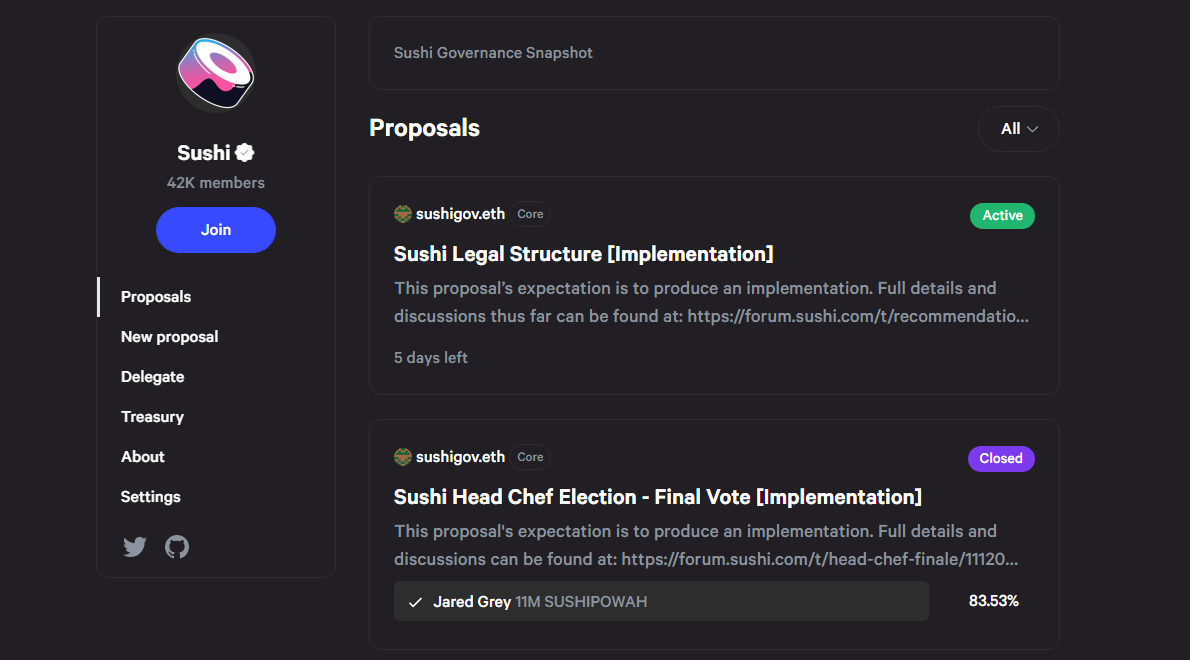

Sushi’s merchandise are designed in order that the whole platform can proceed to innovate on the collective foundations whereas sustaining the decentralized governance of SUSHI token holders.

Whereas the neighborhood votes on vital structural adjustments, our core group finally decides on day-to-day operations, pool and ratio rebalancing, enterprise technique, and general improvement.

What Are Liquidity Swimming pools

Liquidity swimming pools are locations the place tokens are pooled in order that customers can use them to make trades in a decentralized and permissionless method.

Customers and decentralized apps (dApps) that wish to revenue from their use create these swimming pools. To pool liquidity, a consumer’s funds should be equally divided between two cash: the first token (also called the quote token) and the bottom token (normally ETH or a stablecoin).

SushiSwap’s liquidity swimming pools permit anybody to offer liquidity to them in trade for SLP tokens (SushiSwap Liquidity Supplier tokens). A consumer would obtain SUSHI-ETH SLP tokens in the event that they deposited SUSHI and ETH right into a pool.

These tokens symbolize a proportional share of the pooled property, permitting customers to withdraw funds at any time. When one other consumer makes use of the pool to commerce between SUSHI and ETH, a 0.3% payment is deducted from the transaction. 0.25% of that commerce is returned to the LP pool.

With every commerce, the worth of the SLP tokens, which symbolize the shares of whole liquidity in every pool, is up to date so as to add their worth relative to the tokens used to commerce. If there have been beforehand 100 SLP tokens representing 100 ETH and 100 SUSHI, every token can be price 1 ETH and 1 SUSHI (Within the above instance, each ETH and SUSHI have about the identical value).

If in case you have learn our Uniswap deep dive article and observed that the 2 exchanges are very a lot alike: you aren’t flawed. SushiSwap got here to life as a fork of Uniswap’s V2 code. Nevertheless, these days, Uniswap has moved on to its third model, whereas SushiSwap expanded horizontally.

What Are SUSHI, xSUSHI, and SLP Tokens

The SUSHI token is an ERC-20 token. The token serves a number of capabilities inside the ecosystem. SUSHI is a technique of rewarding customers with a portion of the trade charges. The token additionally gives customers with governance rights. You’ve extra voting energy for those who personal extra SUSHI. Notably, SUSHI’s token issuance is restricted to 100 tokens per block.

Nevertheless, SushiSwap Liquidity Supplier (SLP) tokens are proof tokens that show you personal part of the liquidity pool the place your property are staked. Customers are rewarded with SLP tokens once they present liquidity to SushiSwap swimming pools. As a liquidity supplier, you earn buying and selling charges, which you’ll be able to double by farming your SLP tokens.

Lastly, xSUSHi is one more one-of-a-kind token within the community. In trade for staking SUSHI tokens within the Sushibar, you obtain xSUSHI. To create xSUSHI tokens, it’s essential to first stake SUSHI. xSUSHI tokens are extra worthwhile than common SUSHI.

The xSUSHI token is at all times price greater than an everyday SUSHI token as a result of xSUSHI accrues worth from platform charges.

Founders of SushiSwap

SushiSwap, like many different DEX initiatives, was created by a bunch of nameless builders. Nevertheless, Chef Nomi is credited with growing the platform, which went reside in early 2020.

In addition to, SushiSwap has had a tumultuous historical past, regardless of its early declare to fame. This was as a result of when the DEX was launched on Ethereum block quantity 10,750,000, the builders selected to not conduct a pre-mine. As well as, two different pseudonymous co-founders, SushiSwap and 0xMaki, have been concerned within the venture’s early levels.

Sadly, SushiSwap’s builders allegedly rug-pulled the trade in September 2020. A rug pull happens when a venture’s developer abruptly withdraws a big sum of cash from the venture with out warning.

On this case, Chef Nomi has allegedly withdrawn 38,000 ETH from the platform’s liquidity pool. The choice sparked outrage in the neighborhood, with many condemning the maneuver as fraudulent.

At that time, Chef Nomi determined to return the ETH to the pool. Nevertheless, the belief had already been misplaced, and possession of SushiSwap was transferred to Sam Bankman-Fried. Attributable to his stellar observe document available in the market, Bankman-Fried, beforehand the CEO of FTX and Alameda Analysis, assisted in restoring religion within the venture.

Why Is SushiSwap Standard: Drawback-Fixing Advantages

SushiSwap’s design, like Uniswap’s, contributes to market decentralization. Customers can commerce with liquidity swimming pools and non-custodial wallets instantly.

In consequence, SushiSwap is much less prone to be hacked and provides customers better coin choice flexibility. Compared with the competitors, SushiSwap provides customers extra management over the AMM and its future developments.

SushiSwap’s Benefits (SUSHI)

SushiSwap caters to DeFi customers. Anybody can use the platform to swap tokens and add liquidity to swimming pools. SushiSwap provides customers a wide range of methods to earn a passive revenue with minimal danger. SLP tokens can be staked to earn SUSHI, and SUSHI may be staked to earn xSUSHI and rewards.

Revenue From Passive Sources

One of the vital vital benefits of SushiSwap is that almost all of charges are refunded to customers. Liquidity suppliers are rewarded handsomely for his or her extra contributions. The SUSHI/ETH pool pays out double rewards, which is spectacular. SushiSwap is the primary AMM to return all earnings to the neighborhood that runs and maintains it.

Charges

SushiSwap’s charges are decrease than these of centralized exchanges like Coinbase. SushiSwap customers pay a 0.3% payment once they be a part of a liquidity pool. A small transaction payment can also be charged once you approve the pool of a brand new token.

Governance

SushiSwap’s neighborhood governance mechanism permits customers to vote on all crucial upgrades and protocol adjustments. Extra so, a portion of all newly issued SUSHI is put aside for the venture’s future improvement. The neighborhood has the chance to vote instantly on which initiatives deserve this monetary increase.

Assist

Since its inception, the crypto market has proven vital assist for this venture. A number of DeFi platforms have given the platform glowing evaluations. As well as, days after the venture’s public launch, a few of the world’s largest centralized exchanges added the platform’s token SUSHI. This mixture of market and consumer assist aided SushiSwap’s fast progress.

Farming and Staking

SushiSwap provides DeFi customers entry to in style options like staking and farming. Many new customers favor staking to buying and selling as a result of it’s much less time-consuming and gives extra constant returns.

Many individuals additionally surprise if farming SUSHI on different platforms as an alternative of staking is a greater choice. One benefit of staking SUSHI over farming it’s that you should use your staked SUSHI on different DeFi protocols.

Utilizing SushiSwap

There are a number of beginning choices when utilizing SushiSwap, however the most typical is to make use of a fiat on-ramp. To start, you’ll require a centralized trade that accepts fiat foreign money.

Fiat on-ramps will request identification and different info. You’ll be able to fund your account with fiat foreign money and convert it to ETH or the native coin of the blockchain you wish to use when you’ve registered. You’re now prepared for some SushiSwap.

Step one once you arrive at SushiSwap is to pick a liquidity pool. This step could require some crypto asset analysis. Keep in mind that AMMs like SushiSwap don’t require initiatives to endure a verification course of.

We’ll talk about how one can arrange your SushiSwap later on this article however first, let’s see the way it works.

SushiSwap (SUSHI): How Does It Work

SushiSwap is a Uniswap laborious fork, so it’s constructed on the Ethereum Digital Machine (EVM) and helps quite a few blockchains, together with:

- Ethereum Mainnet

- Avalanche C-Chain

- Fantom Opera

- Gnosis

- Arbitrum Nova

- Celo Community

- Arbitrum One

- Polygon Mainnet

- Binance Good Chain Mainnet

- Moonriver

- Moonbeam

- Fuse Mainnet

The core design is sort of equivalent to Uniswap V2, with the first distinction being community-oriented options and advantages.

DEX

The center of the SushiSwap platform is its Decentralized Alternate (DEX). Utilizing this platform, customers can browse a big choice of tokens and commerce their digital property in seconds. SushiSwap by no means holds your tokens as a result of the DEX is non-custodial.

When customers make trades on the SushiSwap trade, a 0.3% payment is charged. 0.05% of this payment is added to the SushiBar pool within the type of LP tokens. When the rewards contract known as (minimal as soon as a day), all of the LP tokens are bought for SUSHI (on SushiSwap Alternate).

The newly bought SUSHI is then divided up proportionally between all xSUSHI holders within the pool, that means their xSUSHI is now price extra SUSHI. Due to the way in which the rewards are generated, the value of xSUSHI will improve with the worth of SUSHI, and the worth of 1 xSUSHI will at all times be better than the worth of 1 SUSHI.

Sushibar

One other cool characteristic that distinguishes SushiSwap is the SushiBar. SushiBar lets you stake your SUSHI in trade for xSushi. After that, you possibly can earn extra rewards by farming within the xSushi pool.

Onsen

Onsen is a liquidity provision reward system for newly issued tokens. So, tokens on the Onsen menu are one other potential supply of yield farming for customers. To encourage liquidity provision, tokens chosen for inclusion on the Onsen “menu” are given an allocation of SUSHI tokens per block.

The benefit of being on the Onsen menu is that initiatives aren’t compelled to incentivize their communities to offer liquidity for his or her tokens as a result of Sushi does it for them. This alleviates the burden of non permanent loss and reduces the value influence/slippage of particular person purchases, making them extra cost-efficient.

Onsen additionally advantages the Sushi ecosystem by making new tokens extra fascinating than established tokens. In consequence, the amount is often a lot increased than that of different tokens, and each xSUSHI holder receives a share of the whole quantity on SushiSwap, which justifies incentivizing liquidity.

Different attention-grabbing options such because the xSUSHI, SUSHI, and SLP tokens, have been defined earlier within the article.

How one can Get Began On SushiSwap Dex

Right here’s an in depth clarification of how one can use the platform successfully.

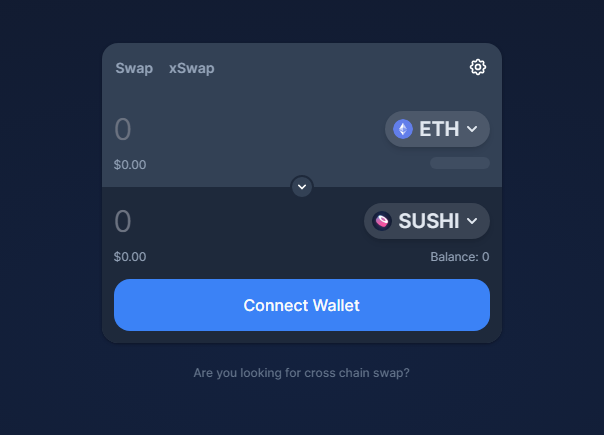

Pockets Setup

Earlier than doing something on SushiSwap, you must arrange and join your pockets. To do that, login to the Sushi web site, and click on on the join wallet icon to see an inventory of wallets to choose from. For simpler steps on how one can arrange your pockets, take a look at the assistance web page right here.

After establishing, the following step is connecting your pockets.

Join Your Pockets

Merely click on on the join pockets icon on the highest proper nook of the location and choose your most popular pockets. You will have to approve Sushi’s entry for every particular person token you employ on the platform. For instance, if you wish to purchase SUSHI tokens with USDC, you’ll must approve Sushi’s entry to the USDC token by paying a small connection payment.

Permitting Sushi entry to your tokens is totally secure, and the Sushi platform won’t be able to conduct any transactions with out your affirmation. You’ve the choice to disconnect your pockets at any time.

How one can Swap

After connecting your pockets, the following step is swapping the token. Right here’s how one can go about it.

Select the token to swap from, enter the quantity, or click on “Max,” then select the token to swap to. Recheck your transaction particulars, then click on “Swap.”

Anticipate the transaction to finish, and your new tokens will seem in your pockets mechanically. (If the token doesn’t seem in your pockets, it’s possible you’ll must comply with the directions beneath).

Discovering Tokens to Swap

In case you can’t discover the token you’re on the lookout for, you should use your most popular blockchain’s block explorer. You could find it by copying its “Token Contract Deal with” and pasting it into the search bar on SushiSwap’s trade. Search for it in a special token listing if it nonetheless doesn’t seem.

After you’ve chosen your tokens, enter the variety of tokens you wish to promote. You’ll see what number of new tokens you’ll obtain, the value influence (which we’ll go over in additional element later), and the whole payment. After granting SushiSwap entry to your tokens and clicking “Swap” after which “Affirm Swap,” your pockets will immediate you to approve the commerce.

Liquidity Idea

An trade is the place you should purchase and promote tokens, however it requires one factor so as to take action: tokens (in any other case often known as liquidity). Usually, centralized exchanges present and handle this liquidity. The liquidity on SushiSwap is offered voluntarily by its customers. SushiSwap rewards those that present non permanent entry to their tokens with a proportional share of the 0.25% payment charged to merchants of the respective token pair.

Impermanent Loss Threat (IL)

Impermanent loss has been outlined because the distinction between the worth of your tokens in a liquidity pool and the worth of your tokens in your pockets for those who held them individually. If one in every of your tokens skyrockets in conventional markets, your SushiSwap property don’t mechanically replace to replicate this.

At this “time lag” stage, merchants should purchase your property within the pool at a lower cost and resell them at a better value on a centralized trade, making an arbitrage acquire. That benefit could possibly be yours! As an alternative, take into account this misplaced alternative to be a brief loss. As a Liquidity Supplier, you settle for this danger (LP).

An LP’s best-case situation is when there are lots of transactions within the pool, and the value of every token doesn’t fluctuate considerably. The better the variety of transactions, the better your share of transaction charges.

So, for those who should earn some yields, it’s best to contemplate the recognition of the pool and your confidence within the value’s stability. For step-by-step particulars on how one can add and take away liquidity, test it out right here.

Staking SUSHI

SushiSwap not solely lets you earn SUSHI, however it additionally lets you earn xSUSHI tokens out of your SUSHI funding.

Whether or not you maintain some other platform tokens or have any liquidity pairs, xSUSHI holders earn 4.5% of all platform transaction charges from Sushi and shortly 2.5% of charges from Shyu. All you might want to get began is a few SUSHI tokens. You’ll be able to go to the Sushi web site for detailed steps on how one can stake and unstake SUSHI.

Is Staking SUSHI Worthwhile

Chances are you’ll surprise what the worth of xSUSHI is. To start with, as beforehand acknowledged, SUSHI holders obtain 0.05% of all transaction charges.

All charges related to the redeployment of restrict orders shall be allotted to xSUSHI holders. With the introduction of the BentoBox and Kashi, charges related to these lending providers may even be allotted to xSUSHI holders.

The liquidity supplier rewards contracts are closed at least one time each day, and all LP tokens are swapped for SUSHI tokens, distributed proportionally to xSUSHI holders. At the moment, xSUSHI can be price greater than the bought SUSHI tokens.

What Are the Dangers of Utilizing SushiSwap

SushiSwap customers should pay transaction charges (also called fuel charges), which might differ vastly in value and make utilizing a selected community costly when a bottleneck happens. DEXs carry various dangers, so do your homework. Bugs in good contracts, for instance, may be exploited.

And since anybody can create a token, maintain an eye fixed out for “rug pulls” of unvetted tokens. “Rug pulls” happen when builders and/or unhealthy actors create and listing tokens on a decentralized trade. Then, they request unsuspecting buyers swap their property for the brand new token, solely to liquidate the token after earnings. This liquidation makes the token’s worth zero.

The place to Purchase SushiSwap (SUSHI)

Relying in your location, you should purchase SushiSwap (SUSHI) on any of the next exchanges:

Bitstamp

Based in 2011, Bitstamp is likely one of the world’s oldest and most trusted exchanges. They at present settle for residents from Canada, United Kingdom, and United States, except for Alabama, Hawaii, Idaho, Louisiana, Nevada, and New Jersey.

Uphold

This can be a prime trade providing a various vary of cryptocurrencies for residents of the US and the UK. Germany and the Netherlands aren’t permitted.

The property out there on Uphold differ by area. All buying and selling is dangerous and should lead to capital loss. As a result of crypto property are largely unregulated, they aren’t protected.

KuCoin

This trade at present helps the buying and selling of over 700 in style tokens. It’s often the primary to offer buying alternatives for brand spanking new tokens. KuCoin is at present open to worldwide and US residents.

WazirX

As a part of the Binance Group, this trade maintains prime quality. WazirX is likely one of the hottest exchanges for Indian residents.

Conclusion

Not many initiatives have survived after a tough knock of controversy. Given its historical past, SushiSwap is one in every of a form on this regard. The mixture of helpful options and neighborhood governance makes this platform a wonderful various to many decentralized exchanges.

Be taught extra about cryptos, keep up-to-date with the markets, and seamlessly handle your crypto portfolio on CoinStats right now.

[ad_2]