[ad_1]

In keeping with 257 economists polled by Reuters, the worldwide financial system is approaching a recession, however 70% of the survey’s individuals consider the possibilities of a pointy rise in unemployment ranges shall be low. The ballot follows the Biden administration and the U.S. Commerce Division issuing a package deal of commerce restrictions towards China’s relationship with the semiconductor trade. The tensions between the U.S. and China have given observers purpose to consider that China might invade Taiwan within the close to future. Accounts stemming from the twentieth Communist Occasion Congress (CCP) convention word that Xi Jinping reportedly mentioned finishing the nation’s management over Hong Kong and “Taiwan is subsequent.”

Polled Economists Consider World Economic system Attracts Nearer to a Recession, Rabobank Market Analyst Says It’s ‘Fairly A lot a No-Brainer’

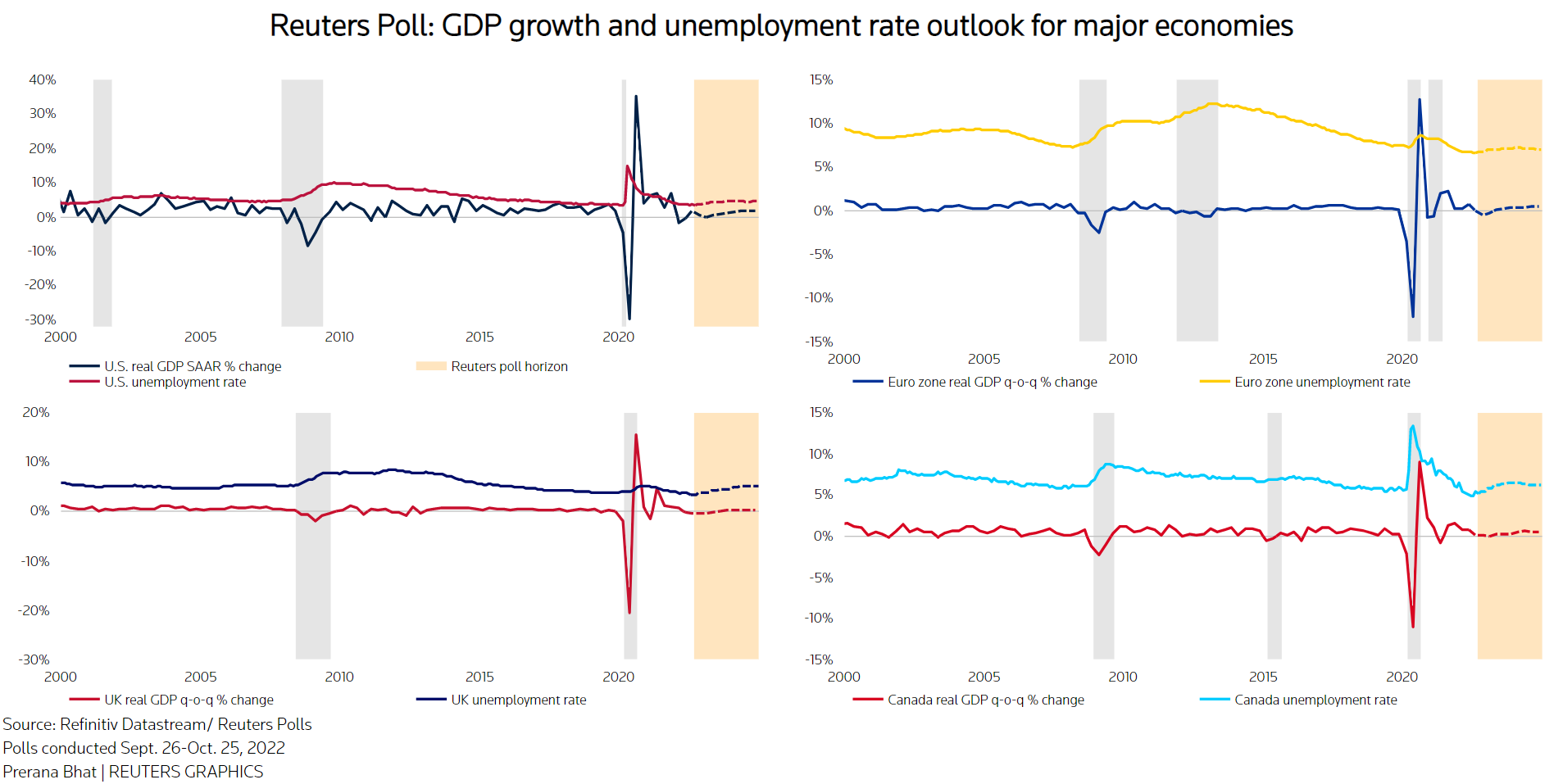

The world’s financial system seems gloomy following the aftermath of the Covid-19 pandemic response, and the current tensions between main nation-states. On a worldwide degree, inflation has skyrocketed in each nation and rising vitality prices tied to monetary sanctions and the continued Ukraine-Russia battle have made issues loads worse. On October 25, Reuters, the information company owned by Thomson Reuters, revealed a ballot that consisted of 257 economists and a majority of the people consider the worldwide financial system is approaching a recession. A worldwide strategist at Rabobank, Michael Each, advised Reuters that the “threat of a worldwide recession” is on the forefront of everybody’s conversations.

“I feel that’s just about a no brainer while you have a look at the pattern in all the important thing economies,” Each mentioned. Furthermore, Each additional added that if unemployment stays robust it offers central banks just like the U.S. Federal Reserve ammo to elevate charges. “The longer [the jobless rate] stays stronger the extra central banks will really feel that they’ll proceed to hike charges,” Each remarked.

70% of the economists polled mentioned the possibilities of a hike in unemployment have been low to very low. The ballot’s information that began on September 26 and thru October 25 is a downgraded outlook in comparison with the stats Reuters recorded in July. “World development is forecast to gradual to 2.3% in 2023 from an anticipated 2.9% this yr, adopted by a rebound to three.0% in 2024, in keeping with Reuters polls of economists masking 47 key economies taken Sept. 26-Oct. 25,” the information company’s reporter Hari Kishan wrote. So far as China, the second largest financial system is anxious, the polled economists say the nation is “anticipated to develop 3.2% in 2022.”

U.S. Tensions With China Elevate, ‘New Export Controls on China’s Chip Business’ Have ‘Assured an Invasion of Taiwan’

The Reuters ballot comes at a time when tensions have been extraordinarily elevated between the USA and China. When the American consultant from California, Nancy Pelosi, visited Taiwan in August, the assembly was thought-about disrespectful to China. On the time, the White Home mentioned China is making ready to hold out “navy provocations” whereas Chinese language warships practiced navy drills within the Taiwan Strait. Earlier this week, the U.S. authorities charged two Chinese language intelligence officers for bribing a authorities worker with bitcoin to entry categorised paperwork.

On October 7, 2022, the U.S. Commerce Division initiated and crafted a package deal of semiconductor-related commerce restrictions towards China. The New York Instances (NYT) reported that the “White Home issued sweeping restrictions on promoting semiconductors and chip-making gear to China, an try to curb the nation’s entry to crucial applied sciences.” Emily Kilcrease, a senior fellow on the suppose tank referred to as the Middle for a New American Safety, advised the NYT the transfer was “an aggressive method by the U.S. authorities to begin to actually impair the potential of China to indigenously develop sure of those crucial applied sciences.”

The newest crackdown on China by the USA has triggered a lot of folks to consider the nation will invade Taiwan. Capitalist Exploits contributor Chris MacIntosh defined that the Biden administration including “new export controls on China’s chip trade” has simply “assured an invasion of Taiwan.” MacIntosh additionally spoke concerning the twentieth CCP convention and famous that China’s president Xi Jinping mentioned management of Hong Kong is now “full” and that “Taiwan is subsequent.” MacIntosh will not be the one person who thinks China will invade Taiwan, because the Sri Lankan geopolitical blogger Dhanuka Dickwella thinks an invasion might occur this winter.

In a current weblog put up, Dickwella additionally talked about the well-documented CCP convention and the forceful removing of China’s former president Hu Jintao. “Hu Jintao’s forceful removing from the celebration congress for the eyes of the entire world thus represents the departure of these approaches,” Dickwella mentioned on October 22. “The method of working carefully with the West in addition to trusting on negotiations for settling the dispute with Taiwan will successfully come to an finish.” On Tuesday, JPMorgan boss Jamie Dimon mentioned tensions between the U.S. and China and the continued Russia-Ukraine battle are “way more regarding” than a recession.

What do you concentrate on the Reuters ballot that exhibits economists consider a recession is close to? What do you concentrate on the stress between the U.S. and China presumably upsetting the invasion of Taiwan? Tell us your ideas on this topic within the feedback part under.

Picture Credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This text is for informational functions solely. It’s not a direct supply or solicitation of a proposal to purchase or promote, or a suggestion or endorsement of any merchandise, providers, or corporations. Bitcoin.com doesn’t present funding, tax, authorized, or accounting recommendation. Neither the corporate nor the creator is accountable, straight or not directly, for any injury or loss triggered or alleged to be attributable to or in reference to the usage of or reliance on any content material, items or providers talked about on this article.

[ad_2]