[ad_1]

Partial Take a look at the Fashions and Positions

On Friday, I used to be a part of the Competition of Studying, sponsored by Actual Imaginative and prescient, to assist new and skilled merchants. The matters that got here up had been in keeping with what everybody who trades needs extra insights on:

- FOMO

- Place Sizing

- Danger Administration

- Entries Stops and Exits

- Portfolio Administration

- Managing Feelings

One query was on AI and Robo Buying and selling, one thing we all know rather a lot about.

First off, having many years of discretionary buying and selling expertise, evolving into algos was a course of. All of our rule-based, structured disciplined approaches as discretionary merchants are an integral a part of the quant fashions and blends. Our purpose is to create an “edge” utilizing fairness traits from varied markets and asset courses.

The explanation I deliver this up right this moment is as a result of most of the positions are inline with our private view of the macro. And most of the positions are following our trend-strength indicators which have positioned us in sectors we might have doubtlessly neglected on our personal. What fascinates me, proper now, is the injection of liquidity by the Fed, which after all will not be being referred to as by its rightful name–Quantitative Easing.

That leads me to think–what else can we purchase now, that hasn’t been crowded by the FOMO crowd?

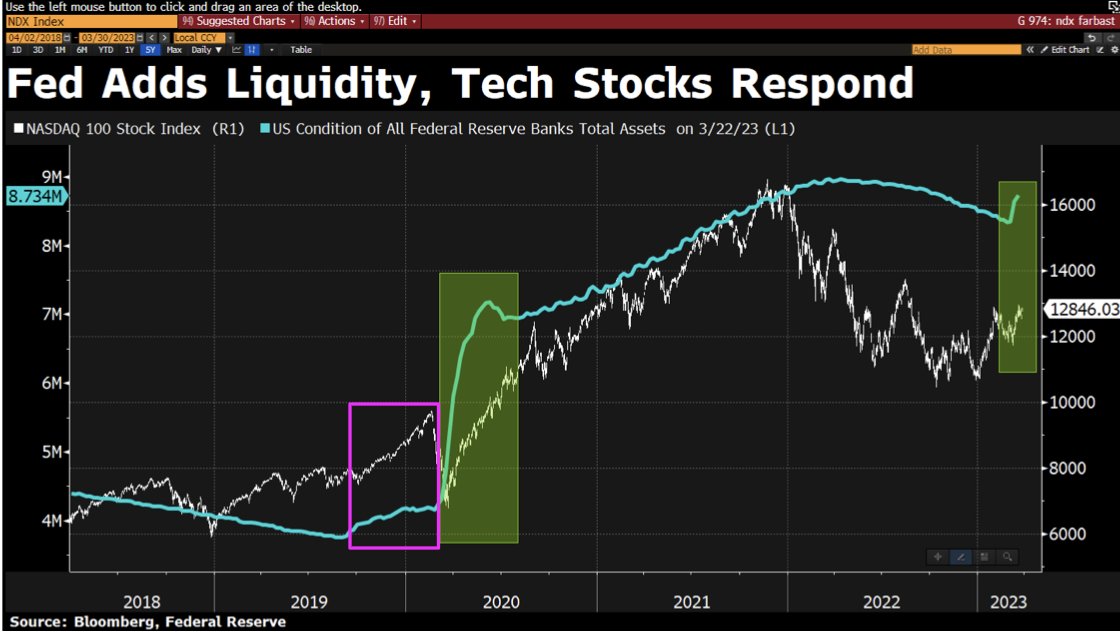

As you may see within the Bloomberg chart, trigger/impact for tech, but additionally for a lot of totally different sectors begging for the Fed repair.

The Financial Fashionable Household, although, has many different points. As the first quarter ended, solely Semiconductors closed above the 2-year or 23-month enterprise cycle to point out enlargement. The remainder of the Household didn’t, and Retail and Regional Banks nonetheless method underperform. Which might imply extra QE on the best way, with the remainder of the indices and key sectors following SMH, or it might imply a wakeup name for the 2nd quarter.

Both method, we nonetheless consider that the majority are #lookingforinflationinallthewrongplaces.

Positive, the market loves the liquidity within the identify of saving any future financial institution points. However every thing although the Fed does, as we properly know, has a price.

Final week, I wrote about agricultural commodities and DBA, the Ag ETF. Since that Day by day, DBA has risen over 4%. So, what ought to we search for subsequent?

I wrote about lengthy bonds (TLT). TLTs rallied with the market. The excellent news is that lengthy bonds are underperforming SPY, which is threat on. If yields fall additional, nevertheless, will that be good for the market when, rapidly, the Fed has to develop into extra aggressive once more to manage rising inflation? Have not we realized but that the extra “QE”, the extra spending, the extra inflation, and so forth?

So, watch the bonds. Take into account the grains. And for the reason that PCE launched Friday excludes meals and power, preserve observe of valuable metals, sugar and crude oil.

Our quants haven’t gotten into oil but, so, from a macro perspective, over $82, we have an interest.

Search for momentum to clear the 50-DMA together with worth. Then, the chance will likely be minimal, and the reward considerably nice.

But additionally, the associated fee to the financial system.

For extra detailed buying and selling details about our blended fashions, instruments and dealer training programs, contact Rob Quinn, our Chief Technique Guide, to be taught extra.

IT’S NOT TOO LATE! Click on right here if you would like a complimentary copy of Mish’s 2023 Market Outlook E-E-book in your inbox.

“I grew my cash tree and so are you able to!” – Mish Schneider

Observe Mish on Twitter @marketminute for inventory picks and extra. Observe Mish on Instagram (mishschneider) for every day morning movies. To see up to date media clips, click on right here.

Mish talks with CNBC Asia about hope, worry, and greed, and what might occur going ahead.

On the Thursday version of StockCharts TV’s Your Day by day 5, Mish walks you thru the place we’re within the financial cycle on the finish of the primary quarter, then highlights what to search for (and commerce) as we enter the second quarter.

On this look on CMC Markets, Mish provides you clear actionable info to assist why commodities look to go increased from right here.

Mish talks in search of inventory market alternatives on Enterprise First AM.

Mish discusses lengthy bonds, Silver to Gold and the Greenback on this look on BNN Bloomberg.

Mish sits down with Kristen on Cheddar TV’s closing bell to speak what Gold is saying and extra.

Mish and Dave Keller of StockCharts take a look at long term charts and talk about motion plans on the Thursday, March 17 version of StockCharts TV’s The Closing Bar.

Mish covers present market circumstances strengths and weaknesses on this look on CMC Markets.

Mish sees alternative in Vietnam, is buying and selling SPX as a spread, and likes semiconductors, as she explains to Dale Pinkert on ForexAnalytix’s F.A.C.E. webinar.

Mish and Nicole talk about particular inventory suggestions and Fed expectations on TD Ameritrade.

Coming Up:

April 4th: The RoShowPod with Rosanna Prestia

April 24-26: Mish at The Cash Present in Las Vegas

Could 2-5: StockCharts TV Market Outlook

- S&P 500 (SPY): 405-410 again in focus.

- Russell 2000 (IWM): 170 assist, 180 resistance nonetheless.

- Dow (DIA): Wants a second shut over 332.

- Nasdaq (QQQ): 329 the 23-month shifting average–huge.

- Regional Banks (KRE): Weekly worth motion extra contained in the vary of the final 2 weeks–still appears weak.

- Semiconductors (SMH): And he or she’s off–255 key assist, 270 resistance.

- Transportation (IYT): Cleared the weekly shifting common, so now has to carry 225.

- Biotechnology (IBB): Good efficiency however not sufficient but, until clears 130 space.

- Retail (XRT): Ran proper to huge resistance at 64.

Mish Schneider

MarketGauge.com

Director of Buying and selling Analysis and Training

Mish Schneider serves as Director of Buying and selling Training at MarketGauge.com. For almost 20 years, MarketGauge.com has offered monetary info and training to hundreds of people, in addition to to giant monetary establishments and publications similar to Barron’s, Constancy, ILX Methods, Thomson Reuters and Financial institution of America. In 2017, MarketWatch, owned by Dow Jones, named Mish one of many prime 50 monetary folks to comply with on Twitter. In 2018, Mish was the winner of the Prime Inventory Choose of the yr for RealVision.

Subscribe to Mish’s Market Minute to be notified at any time when a brand new publish is added to this weblog!

[ad_2]