[ad_1]

Zima Crimson provides readers the weekly pulse on the largest information round NFTs. Be part of our neighborhood and take the journey with us by subscribing right here:

Hey everybody! Right here’s what we obtained for you this week:

Information

Market

Collectibles

-

One thing unusual occurred with CryptoPunks…and now we all know why

-

Reality Labs is revealed because the staff behind Goblintown

Gaming

Digital Worlds

+ The Zima Crimson Podcast

📰 Information

Why try to be frightened about Celcius and 3AC going underneath

Three Arrow Capital (3AC), the crypto-focused, Singapore-based hedge fund is rumored to be bancrupt. 3AC backs many extremely notable crypto initiatives and Vincent Van Dough’s $100M NFT fund.

Crypto lender that has come underneath fireplace after it froze withdrawals final weekend, citing “excessive market circumstances.”

Each 3AC and Celcius’ troubles are linked to the low cost between Lido Finance’s Staked Ether (stETH) and the spot worth of Ethereum – the 2 are purported to be pegged 1:1. 3AC and Celcius each held (and dumped) A LOT of Staked Ether.

So why must you be frightened?

*FYI, the $ quantity of 3AC’s liquid portfolio (previous to the crash) varies tremendously. $9B is the quantity that we’ve seen probably the most.

-

3AC borrows from each main lender (BlockFi, Genesis, Nexo, Celsius) thus each lender will and has taken successful due to this.

-

Their $9B liquid portfolio is at the very least down an ultra-conservative ~70% —> Now $2.7B

-

Rumors are their portfolio is nearer to <$1B that means they might be unable to satisfy their margin calls

3AC is among the greatest debtors of crypto lenders globally.

-

The lenders will face an enormous P/L distinction between how a lot they’re owed and what they’ll get from liquidating 3AC’s collateral

-

Working a ten/20B portfolio with a 5% fairness buffer – these lenders are massively ill-prepared that means defaults will trigger a major fairness erosion.

A significant lender and a serious fund each collapsing isn’t any bueno. ETH and BTC and by proxy NFTS (in USD at the very least) would get proceed to get rekt as a result of folks might be pressured to promote what they’ll (no liquidity in alts.)

OpenSea’s Seaport improve cuts gasoline charges by 35%

OpenSea formally moved to the open-source Seaport protocol on June 14th. They estimate it should save customers a mixed $460 million in complete charges annually.

Issues to notice:

-

Now you can make affords on objects in a whole assortment or by objects with a selected attribute

-

New accounts will now not require the one-time setup charge OpenSea had beforehand charged

Coming quickly:

-

Itemizing a number of NFTs in a single transaction

-

A number of payout addresses

📉 Market

Stanley Druckenmiller’s up to date worldview

Stanley Druckenmiller is a billionaire hedge fund supervisor in addition to a bitcoin bull, albeit not overly verbose about it. He has been signaling inflation worries for over a 12 months now and simply up to date his worldview in a chat with Stripe co-founder John Collison on the Sohn convention.

He was shocked by:

-

The magnitude of inflation

-

How aggressively the bubble burst

-

Valuations have reset as lots of good (public) corporations are down 60-70% with no important change of their fundamentals

-

-

The fed was actually sluggish to acknowledge the issue

-

he thought they have been sluggish in April of ‘21 however they didn’t pivot verbally till November and have been nonetheless shopping for bonds in March ‘22!!

-

He stated that in his 45 years, he has by no means seen a mixture the place there is no such thing as a historic precedent.

-

8% inflation right into a weakening financial system with bond yields at 3%

Kinda apparent however Druck says there’s a excessive correlation between BTC & the NASDAQ and that there’s a excessive overlap between the asset class house owners.

His recommendation to 20-year-old tech buyers could be to spend as a lot time within the crypto, just like the web.

Why we’re bearish for the subsequent few months

SuburbanDrone (an account that we fairly like for macro commentary) predicted how Fed tightening will play out this summer time within the Nasdaq. The crypto markets are carefully correlated to the Nasdaq.

-

4x tightening means 3 charge hikes and $45b QT in June

-

5x means 3 charge hikes and $60b QT in July

-

6x means 2 charge hikes and $90b QT by September

Arthur Hayes additionally introduced up an vital state of affairs in his most up-to-date weblog submit.

By June 30 (second quarter finish), the Fed can have enacted a 75bps charge hike and begun shrinking its steadiness sheet. July 4 falls on a Monday, and is a federal and banking vacation. That is the right setup for one more mega crypto dump. There are three components to this humble pie:

Threat property will once more rediscover their dislike for tightening USD liquidity circumstances sponsored by the Fed.

Crypto funds should elevate fiat to fulfill redemption necessities by persevering with to promote any liquid crypto asset.

No fiat might be deployed till Tuesday, July 5.

June 30 to July 5 goes to be a wild trip to the draw back.

Why we’re bullish long run

The metaverse is actual and it is taking place now.

Crypto = cash of the metaverse

NFTs = all the products within the metaverse

Regardless of the costs of crypto, the metaverse isn’t going away

👤 Collectibles

One thing unusual occurred with CryptoPunks… now we all know why

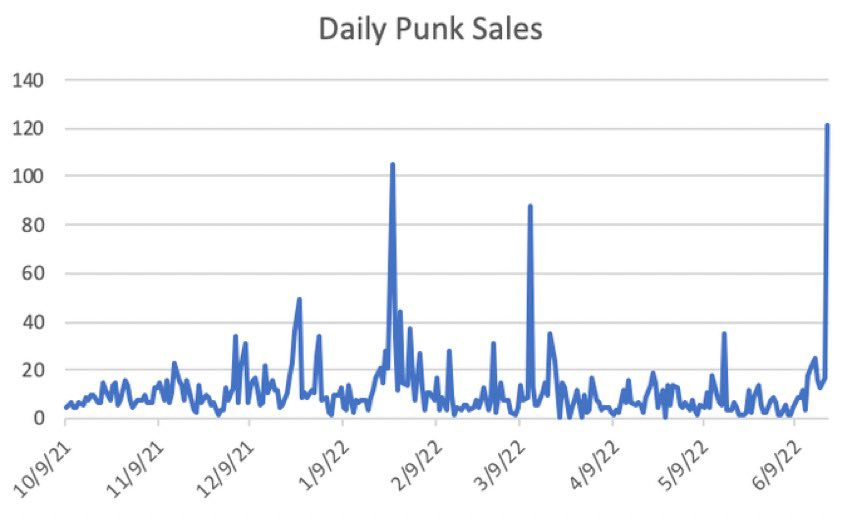

One thing uncommon was occurring with CryptoPunk quantity. The best variety of gross sales within the final 12 months+ occurred in a condensed timeframe.

Seems insiders have been front-running the information that NonFungibleNoah could be leaving Christie’s to take over because the CryptoPunks model lead.

Essential takeaways from the announcement:

-

No Punks on lunchboxes or in motion pictures

…thats about it up to now.

Noah needs to be sure that, for probably the most half, much less is extra. He wished to make sure the neighborhood understands that the Punks ethos will stay unaltered by him or Yuga.

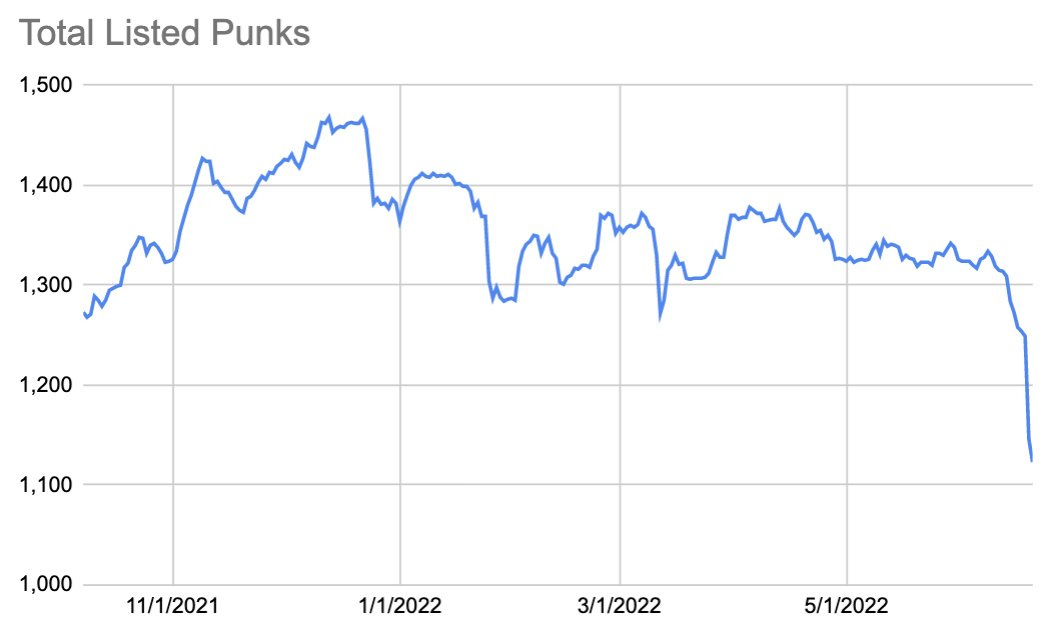

Complete Punks listed has additionally dropped a ton!

Reality Labs is revealed because the staff behind Goblintown

As many had suspected, Goblintown was launched by an skilled staff. Reality labs are additionally the staff behind The Illuminati Collective and The 187.

Comply with Zima Crimson on Twitter

🕹 Gaming

Advantage Circle DAO vs YGG

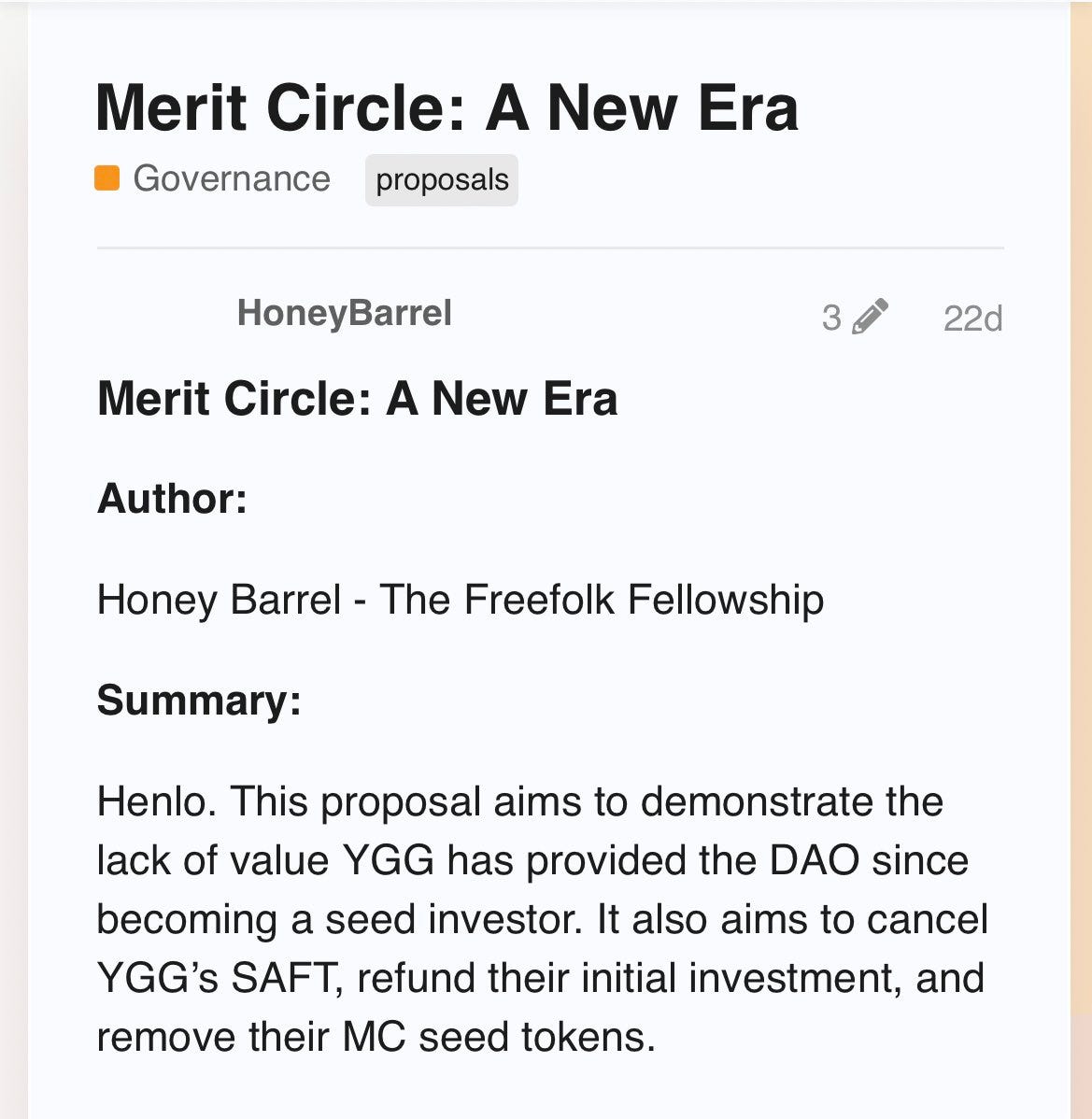

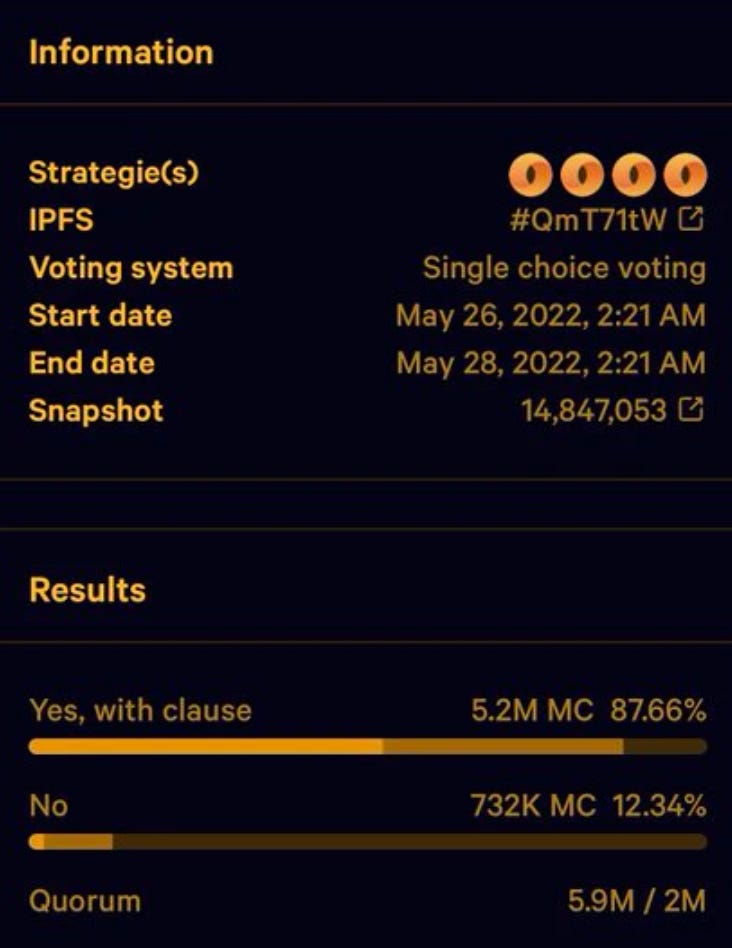

A decision has lastly been reached relating to the Advantage Circle DAO vs YGG drama.

Backing up a bit – Advantage CircleDAO wished to cancel Yield Guild Video games SAFT, refund their preliminary funding, and theoretically lower them out of a 30X (after the completion of a 4-year vesting schedule) return for “not offering any worth.”

A proposal laying this all out hit the Advantage Circle DAO discussion board on Might twentieth and was met with resounding help 👇

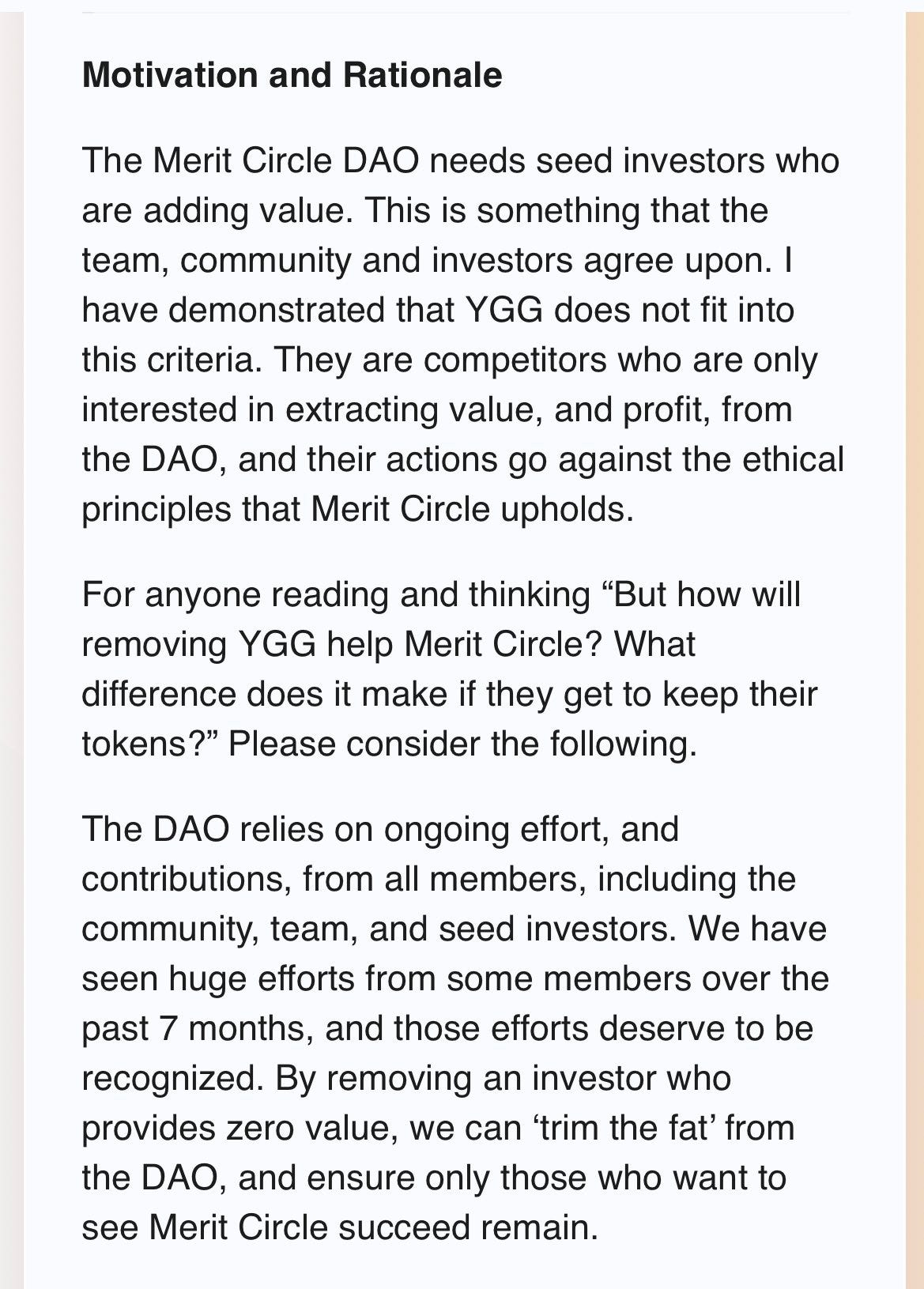

YGG snapped again of their weblog 5 days later mainly stating that they have been underneath no authorized requirement to supply something however $$$

Full quote:

…not one of the seed buyers are obligated underneath the authorized documentation of the SAFT to supply any particular worth add companies. Additional to that, there is no such thing as a provision for Advantage Circle Ltd to unilaterally cancel the contract no matter how this has been introduced by them to the neighborhood.

Though the Advantage DAO core staff (Advantage Circle Restricted) stated that they would favor to “honor all agreements,” the DAO itself legally held the authority of the tokens by way of the investor settlement.

The official vote handed with flying colours on Might twenty eighth.

The Advantage Circle Core staff stepped in and renegotiated to permit YGG to take a “diminished return” on their funding.

A proposal handed for Advantage Circle DAO to purchase out all of YGG’s locked tokens for $0.32/token. This could internet them $1.75M as an alternative of the ~$5M (or extra) that they might have acquired following their vesting schedule.

YGG formally agreed to the buyout on June 14th.

The staff behind Phrases with Associates is constructing an NFT recreation

Phrases with Associates developer Playful Studios has raised $46M to construct out The Wildcard Alliance NFT recreation. Playful Studios thinks by constructing Wildcard Alliance to be straightforward, accessible, and enjoyable., they’ll onboard the subsequent billion avid gamers to web3. The sport will function parts just like Hearthstone or Magic: The Gathering the place you handle card decks. It’s going to additionally embrace the gameplay of a multiplayer on-line battle area (MOBA) recreation or an area recreation like Rocket League.

🌐 Digital Worlds

Why the metaverse wants crypto

The legendary Punk 6529 wrote one other nice thread. This time on why the metaverse wants crypto.

Listed below are the takeaways:

-

The metaverse is an summary layer of the web – however nonetheless the web

-

The visualization layer of the web

-

4k Video & world video conferencing —> Purposeful prolonged and blended actuality

-

-

Most time might be spent in augmented actuality (partial augmentation) not digital actuality (absolutely immersive)

-

FYI some folks like Sam Lessin ( VC and one in every of Zucks finest associates) disagree and suppose it’s going to be the opposite method round

-

-

The motion to AR/VR might be seen as a life-style enchancment and can make bodily places irrelevant for enterprise aside from the social facets (ingesting & consuming)

A very powerful questions for the well being of the web/metaverse/human society might be determined now.

Who shops the definitive possession data of these digital objects?

There are two solutions: an organization’s database OR a blockchain

If it’s an organization’s database, that can result in the identical issues seen in web2..however worse.

Why:

-

Lease-seeking platforms like Fb

-

47.5% charge on metaverse gross sales – increased than a socialist tax regime

-

-

If the metaverse is your digital actuality and you’ll be banned primarily based on an algorithm, that’s terrifying

-

Political safety

-

The persistence and ambiance of the metaverse would make its influence on elections, et al 100x worse than Fb/Twitter

-

-

International nationwide safety

-

What if the video that was captured by augmented actuality glasses was hosted on an organization’s database?

-

(insert vital individual)’s personal moments are despatched to those databases

-

It’s obtained by hackers, and so on.

-

If the possession data are on public blockchains, these issues are averted.

NFTs > personal firm databases

🎙 Zima Crimson

Kevin is the founding father of Atmos an upcoming recreation universe that mixes sports activities, lore, and crypto-economics to create an interesting and aggressive digital expertise

On this episode we chat:

-

Being a crypto founder in 2013

-

Trying to construct a fantasy NFT basketball recreation in 2019

-

Sports activities as the last word malicious program to crypto mass adoption

-

Balancing skill-based gameplay with crypto-economics

-

Making a aggressive recreation mixed with a digital world

-

Atmos preliminary core recreation loops of Mining – FGabricating – Racing

-

And a lot extra

[ad_2]